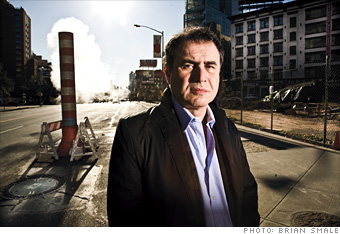

- Nouriel Roubini

What He says now " We are in the middle of a very severe recession that's going to continue through all of 2009 - the worst U.S. recession in the past 50 years. It's the bursting of a huge leveraged-up credit bubble. There's no going back, and there is no bottom to it. It was excessive in everything from subprime to prime, from credit cards to student loans, from corporate bonds to muni bonds. You name it. And it's all reversing right now in a very, very massive way. At this point it's not just a U.S. recession. All of the advanced economies are at the beginning of a hard landing. And emerging markets, beginning with China, are in a severe slowdown. So we're having a global recession and it's becoming worse. "

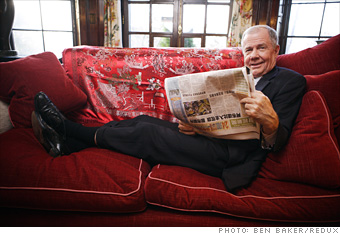

- Jim Rogers

He says " A bubble is building up in the US treasury Bonds, Current US markets valuations are not attractive says fair value at 4000 for DOW "

- Meredith Whitney

She says " So far we've had TARP 1.0, TARP 2.0, and TARP 3.0, and I'm certain there will be a 4.0, a 5.0, and a 6.0. There has to be, because the companies cannot raise the capital they need, which means that the default provider of capital has to be the federal government.

What happens in 2009? Frankly, it's hard for me to predict what's going to happen next week, never mind next year. What I will say is that I expect all these banks to be back in the market looking for more capital

If 2008 was characterized by the market impacting the economy, then 2009 will be about the economy impacting the market. It's already started. "

Source : Forbes.com

0 comments:

Post a Comment