News Today - June 30

*Bernard Madoff, 71, was sentenced to 150 years in prison after defrauding investors of billions in the largest Ponzi scheme in history. He told U.S. District Judge Denny Chin he had no excuses. "I don't ask for any forgiveness," he said. Flanked by federal marshals, he sat silently as former investors assailed him for a fraud that cost many of them their life savings.

* The U.S. economy isn't likely to recover until "well into 2010," Wilbur Ross, chairman and CEO of WL Ross & Co., said Monday.

* Crude oil rose to an 8-month high and is set for its biggest quarterly gain since 1990, as the U.S. dollar declined and militant attacks in Nigeria raised concern that supplies may be disrupted.

* The outlook for emerging markets is “far more optimistic” than for developed economies, Investor Marc Faber said. “We are living through major changes in the world,” said Faber, the publisher of the Gloom, Boom and Doom report. Emerging markets are becoming more significant to the global economy, a trend unlikely to be reversed, he said today at a forum in Seoul.

News Today - June 29

* Economy hits marriage choices in India

* The central bank governors of China and Brazil reportedly agree in principle to allow trade between the two countries to be settled in their respective currencies.

* Indian stocks emerged as the best performers among those in the emerging and the developed markets across the globe so far this year, giving investors the highest return of nearly 60 per cent.

* SEBI is considering increasing stock exchange trading hours so that market participants in India are better placed to react to developments in global markets. If the proposal is approved, the equity market will be open for trading from 9:00 am to 5:00 pm.

News Today - June 26

* Michael Jackson, the child star turned King of Pop who set the world dancing but whose musical genius was overshadowed by a bizarre lifestyle and scandals, died on Thursday. He was 50.

* Japanese regulators are said to be set to order closure of some of Citi's retail operations due to lax money laundering controls.

* New Zealand's economy suffers a record fifth-straight decline, as the nation sinks further into its worst-ever recession.

* The Indian Government on Thursday set in motion the process of providing a Unique Identification Number to India's citizens and appointed Infosys Technologies Co-Chairman Nandan Nilekani as head of an Authority for this purpose.

News Today - June 25

* Japan’s creditworthiness worsened in the past three years, though not enough for Standard & Poor’s to lower the country’s rating from AA, said Takahira Ogawa, the company’s sovereign rating director.

* Buffett: No Green Shoots At All

* Ireland faces the worst recession in the developed world and a particularly long struggle to bail out its property-crippled banks , the International Monetary Fund forecast on Wednesday.

* The Federal Reserve sought to hide its involvement in Bank of America's acquisition of Merrill Lynch as Merrill's financial condition worsened, the top Republican on the House Oversight and Government Reform Committee said on Wednesday.

Link Dumps - 24.6.09

OECD Raises Outlook for First Time in Two Years

The combined economy of the world’s most-industrialized countries will shrink 4.1 percent this year and grow 0.7 percent in 2010, the Paris-based group, which was founded in 1961 to coordinate international economic policies, said today. The new projections compare with March forecasts for contractions of 4.3 percent and 0.1 percent.

The improved outlook conflicts with that of the World Bank, which this week said the global recession will be deeper than it predicted three months agoKeep reading... http://www.bloomberg.com/apps/news?pid=20601087&sid=a57voXeY6ODQ

News Today - June 24

*China defended itself against charges from the U.S. and Europe that its restrictions on raw materials exports violated international trade rules, saying those restrictions were in keeping with WTO regulations.

* Despite China’s reputation as a nation of savers, the central bank says Chinese consumers are increasingly falling behind on their credit-card payments, suggesting a move toward Western-style spending

* The Chinese economy is headed in the right direction, but the foundations of the recovery are not yet solid, Su Ning, a vice-governor of the People's Bank of China, said on Tuesday.

* Economics professor Mark Gertler, a former close colleague of Fed chief Ben Bernanke, says the U.S. central bank is unlikely to rush into any 'exit strategy' from current policy just yet.

* President Barack Obama said a second stimulus package isn’t needed yet, though he expects the U.S. unemployment rate will exceed 10 percent this year.

Link Dumps - 23.6.09

Moody's: US Rating Safe but Depends on Debt, Dollar ( Cnbc )

Pessimistic executives cash out of shares (FT)

"THE MOTHER OF ALL DEPRESSIONS”? (pragmatic capitalist )

Good Read : Science of Economic Bubbles and Busts

Read to understand the science behind the great Economic bubbles and their collapses..

http://www.scientificamerican.com/article.cfm?id=the-science-of-economic-bubbles

Link Dumps - 22.6.09

Budget will be populist says Montek ( Rediff )

Apple sells more than 1 million Iphone 3GS models ( Marketwatch )

California's unemployment rate in May hit 11.5% ,highest level in more than three decades (LA Times )

World Bank cautions against recovery talk (telegraph.co.uk)

The trillion dollar drain on the world's poor (guardian.co.uk)

China Metallurgical prepares for biggest IPO of the year

China Metallurgical Group, a diversified resources conglomerate, is preparing a blockbuster double stock market listing in Hong Kong and Shanghai later this year, according to people familiar with the matter.

The Hong Kong H-share could raise up to US$2.7bn, said people familiar with the matter, and so possibly become the world’s largest initial public offering of 2009.More at : http://www.ft.com/cms/s/0/eec10b2a-5f17-11de-93d1-00144feabdc0.html?nclick_check=1

News Today - June 22

* In what appears to be the sharpest and broadest unrest in Iran in the 30 years since the shah was overthrown, at least 10 people have been killed and more than 100 injured, media reports say.

* With the recession easing, Federal Reserve policymakers are unlikely to launch any major new efforts to revive the economy when they this week.

* Wipro Technologies

founder Azim Premji, has stressed that the recent American decision to clamp down on H1B

which could halve the number of Indian IT specialists entering the country, would be counter-productive.

* The Japanese government reports business sentiment has significantly improved among large companies, but although more, similarly upbeat economic data are expected this week and next, Japanese investors remain cautious for now.

* India’s Met office is reasonably sure that the elusive monsoon would arrive in Mumbai and the western coast over June 21-23.

* The World Bank said the global recession this year will be deeper than it predicted in March and warned that a flight of capital from developing nations will swell the ranks of the poor and the unemployed. The world economy is forecast to contract 2.9 percent this year, compared with a prior estimate of a 1.7 percent decline, the Washington-based lender said in a report released today.

Merkel Sees German Economy Near Bottom

The chart of the German economy may look more like a “bathtub” than a “V” as output stagnates before recovering, she said, according to the news agency. “I hope it is a children’s bathtub and not a bathtub for people with particularly long legs,” Merkel is quoted as saying by the AP.

News Today - June 19

* Continuing US jobless claims fell by 148,000 to 6.68 million during the week ended June 6, the lowest level in about a month. The four-week average of continuing claims rose, however, by 2,250 to 6.75 million.

* Financial markets have shown vast improvement since last fall and there are signs of stabilization in the British economy after a steep plunge in output, Bank of England Gov. Mervyn King said at an event in London's financial district.

* Indian firms have contributed $105 billion (Rs 5.25 lakh crore) to the US economy between 2004 and 2007 apart from creating 300,000 jobs, Commerce and Industry Minister Anand Sharma says.

* The Indian wholesale price index (WPI)-based inflation went sub-zero for the first time in 35 years for the first week of June, but top policy makers and economists dismissed it as a short-term statistical phenomenon, with no real implications for either the country’s growth or its monetary policy.

U.S. leading economic indicators rose 1.2% in May

The Conference Board’s gauge increased 1.2 percent after a revised 1.1 percent in April, the biggest back-to-back gain since November-December 2001, according to data the New York- based group released today. The index points to the direction of the economy over the next three to six months.

Obama Sees 10% Unemployment Rate in US

“Wall Street seems to maybe have a shorter memory about how close we were to the abyss than I would have expected,” Obama said, referring to criticism of the government’s growing role in the economy and markets.

Source : http://www.bloomberg.com/apps/news?pid=20601087&sid=auTTvgeN294Y

5 factors that could hurt an economic recovery

1.The Oil spike

Crude oil has been surging ever since the talks of economic recovery started doing rounds. Expectations that China will continue to grow at a faster pace and emerging economies will get back to growing ways have lead to the notion that demand for oil will be high. OPEC recently announced that worst of oil crisis may be behind us and expects demand for oil to stabilize and tick up in coming years. Goldman Sachs revised higher its year end target for oil. Also the falling dollar has supported the oil prices. Any further spike in oil prices could end up hurting the prospects of an quick economic recovery.

2. The Swine flu pandemic

WHO raised the flu alert level to six, making it first global pandemic in four decades. Influenza virus typically spread in waves getting stronger with each wave. The second wave that seems to have started has already spread its wings across many nations including India. The World Bank estimated in 2008 that a flu pandemic could cost a damage of $3 trillion to the world trade. Although the swine flu has caused relatively less mortality, any further severity might be a dampener to world trade.

3. Political unrest

Defiant North Korea announced that it will continue to enrich its nuclear capabilities and reportedly is readying itself for a 3rd missile test in spite of UN sanctions and warnings from USA, raising tensions in the region. N Korea has also threatened war if further sanctions were imposed on them. A war is last thing that the world would like to see amidst the financial crisis. In the Middle East, if tensions between Israel and Iran escalate, that would send oil prices soaring again.

4. Rampant inflation

Although not a near term issue, if the economic recovery turns out to be strong and with higher oil prices and monetary easing from central banks around the world, inflation could begin to sky rocket. Higher inflation with stagnant growth will lead to "Stagflation" a period of slow growth with high inflationary pressures.

5. Public debts

Another crisis that looms near the horizon is enormous public debts. Governments around the world borrowed huge amounts of money to steer through the worst financial crisis since the 1930's. It was necessary to save the economy from falling into a deeper hole and to bail out large banks. But in the long run, such enormous debts are unsustainable, already there are worries that some Euro zone nations could default their debts or lose their credit ratings. Unsustainable debts are a cause of worry and needs to be tackled sooner or later.

Prakash

Roubini says oil, gold look overpriced

Roubini, who is known for having predicted the financial crisis that rocked the global economy in the past two years, painted an economic backdrop of deflationary risks and warned that if oil keeps climbing toward the $100 level it would deal an "economic shock" similar to the one last seen in 2008.

The recent rally in oil, which sent prices to an eight-month high above $73 per barrel, was "too high too soon," Roubini told the Reuters Investment Outlook Summit in New York.

Keep reading... http://www.reuters.com/article/InvestmentOutlook09/idUSTRE55F4YM20090616

News Today - June 15

* President Barack Obama said the government can save $313 billion over the next 10 years by forcing greater efficiency in Medicare, demanding better prices from drugmakers and cutting the number of uninsured Americans.

* Reports on manufacturing and housing this week will probably offer evidence that the recession- stricken U.S. economy is within months of hitting bottom, economists said.

* Treasuries rose for a third day after Russian Finance Minister Alexei Kudrin said his nation has confidence in the dollar and there are no immediate plans to switch to a new reserve currency.

* Investors have basked for months in a powerful stock and corporate credit market rally, but the glow may fade as unprecedented measure

News Today - June 12

* Bank of America chief Ken Lewis says he felt pressure from the Federal Reserve and Treasury when he hinted he'd balk at the Merrill Lynch deal.

* BlackRock, the giant U.S. money manager, said on Thursday it will buy Barclays Global Investors for $13.5 billion in a deal that will make it the world's biggest asset manager.

* India's largest software exporter, Tata Consultancy Services, is hopeful but cautious that the worst is now over, the company's chief financial officer says in an interview.

* WHO declared swine flu a global pandemic, says its spreading fast.

Oil rises to $72

World oil demand will contract by less than previously expected this year, the International Energy Agency said as it raised its 2009 forecast for the first time since August 2008

U.S. crude rose 71 cents to $72.04 a barrel by 1105 GMT (7:05 a.m. EDT), a near eight-month high. Brent crude gained 50 cents to $71.30.

Falling inventories in top oil consumer the United States also supported prices.

News Today - June 11

* The economy's sharp slide eased in the late spring and hopes for future business activity improved, suggesting that the worst of the recession has passed , Fed Beige book said.

The so-called Beige Book, a snapshot of economic conditions around the US, said five of the Fed's 12 regions reported that the "downward trend is showing signs of moderating."

* China’s exports fell by a record as the global recession cut demand for goods produced by the world’s third-largest economy. Overseas sales dropped 26.4 percent in May from a year earlier, the customs bureau said in a statement on its Web site today.

* Japan’s economy shrank less than the government initially estimated as business investment and inventories fell at a slower pace. Gross domestic product shrank at a record 14.2 percent annual pace in the three months ended March 31, less than the 15.2 percent reported last month, the Cabinet Office said today in Tokyo.

* Brazil, Russia, India and China’s plan to shift some foreign reserves into International Monetary Fund bonds may be more a signal of their growing financial clout than a lack of demand for U.S. assets , Goldman says.

UK Industrial output posts a surprise rise

UK Industrial output in April rose 0.3 per cent from March, according to the Office for National Statistics, the first rise since February 2008. Analysts had forecast a fall of 0.1 per cent.

In a further boost to confidence, manufacturing output between March and April rose 0.2 per cent. It was the second month output rose after March's previously reported drop of 0.1 per cent was revised up.

The data is the latest in a spate of more upbeat indicators about the economy.

Last week, a key survey suggested that during May service industries, the engine room of the economy, grew for the first time in more than a year. The CIPS/Markit barometer of services conditions climbed to 51.7 from 48.7 in April in a sixth consecutive rise, taking it back above the key 50 mark that signals renewed expansion.

Continue reading.. http://business.timesonline.co.uk/tol/business/industry_sectors/industrials/article6469221.ece

Peter Schiff on The Daily Show

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c |

| Peter Schiff | |

| thedailyshow.com | |

Nassim Taleb : Authorities 'Will Fail Us Again'

The main problem is the level of debt, and Taleb compared the authorities' efforts with those of a not very skilled pilot who is trying to land a Concorde on a narrow strip, between an ocean of deflation and a mountain of hyperinflation."These people failed us, they're going to fail us again," Taleb told cnbc.

More at : http://www.cnbc.com/id/31203621

News Today - June 10

* Chinese economic data due this week are expected to show a puzzlingly mixed picture, underscoring the difficulty of figuring out what's going in China's vast economy.

*Australian consumer confidence jumped in June by the most in 22 years after the economy unexpectedly avoided a recession; stoking speculation the central bank has finished cutting interest rates.

*A key indicator of Japanese corporate capital investment slips far more than expected, while wholesale prices also look ugly.

* Indian Consumers might have to shell out a higher cess on auto fuels if the government goes ahead with a proposal to step up funding for highways. The roads and surface transport ministry has suggested a Re 1 hike in auto fuel cess.

Krugman Sees U.S. Recession Ending Soon

“I would not be surprised if the official end of the U.S. recession ends up being, in retrospect, dated sometime this summer,” he said in a lecture today at the London School of Economics. “Things seem to be getting worse more slowly. There’s some reason to think that we’re stabilizing.”

Krugman, a Princeton University economist, has warned recently that the U.S. government hasn’t done enough to help the country’s economy recover. Last month, at a conference in Abu Dhabi, he said the fiscal stimulus is “only enough to mitigate the slump, not induce recovery.”

Even with a recovery, “almost surely unemployment will keep rising for a long time and there’s a lot of reason to think that the world economy is going to stay depressed for an extended period,” Krugman said.

Full article at : http://www.bloomberg.com/apps/news?pid=20601087&sid=ayAXvw0Mc3CY

News Today - June 09

* Apple Inc. announced a new version of its popular iPhone on Monday, upping the stakes in the fast-growing market for smart phone devices. The new version is named Iphone -3GS, its said to be twice faster than the previous versions.

* Vice President Joe Biden on Monday is presenting to President Obama the "Roadmap to Recovery," a plan to accelerate the implementation of the $787 billion stimulus plan in its second 100 days.

* Finance ministers from the Group of Eight leading economies are poised to offer a brighter assessment of the global economy at a two-day meeting scheduled for this weekend, reports said Tuesday.

* The US Treasury is preparing to announce tomorrow it will let 10 banks buy back government shares, people familiar with the matter said, signaling confidence some of the largest U.S. lenders won’t again need a taxpayer rescue.

* Pacific Investment Management Co., which runs the world’s biggest bond fund, said the economic outlook “looks bad” for most of the world and central banks will refrain from raising interest rates.

News Today - June 08

* Indian outsourcing giant Infosys reportedly plans to join several of its rivals by moving some of its business overseas to Brazil.

* The U.S. Supreme Court is expected to decide today whether a group of shareholders can continue attempts to block Chrysler LLC's sale of top assets to Italian automaker Fiat. full story

* Citigroup may soon sell off part or all of its 11.73% stake in India's largest mortgage lender, HDFC Bank Ltd , according to a report Monday in India's Economic Times.

* A top Chinese banker on Sunday called on the U.S. government and the World Bank to sell yuan-denominated bonds in Hong Kong and Shanghai to encourage the development of debt markets in those centers and to promote the yuan as a major international currency.

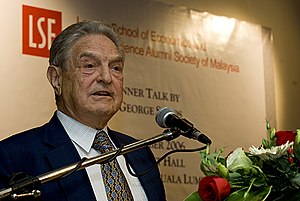

* Financier George Soros said on Sunday that China's global influence is set to grow faster than most people expect, with its isolation from the global financial system and a heavy state role in banking aiding a relatively swift economic recovery. He reiterated his cautious views regarding the surge in global stock markets, although he said it may have further to go given liquidity in the markets and that many investors are still sitting on the sidelines.

Jim Rogers : Don't Short the Markets

"I’m afraid they're printing so much money that stocks could go to 20,000 or 30,000," Rogers said. "Of course it would be in worthless money, but it could happen and you could lose a lot of money being short."

Rogers feels that a currency crisis looms in near future , He called the US dollar a "terribly flawed currency," adding that it could be the starting point for the next currency crisis.

He is bullish on commodities and says investors should turn toward commodities. This sector will lead the recovery if the global economy improves, and if it doesn't, they'll still be the best place because of inflation.

U.S. Job Losses Slow Down, Unemployment rate hits 9.4%

Payrolls fell by 345,000, the least in eight months, after a revised 504,000 loss in April, the Labor Department said today in Washington. The jobless rate increased to 9.4 percent, the highest since 1983, in part as more people joined the labor force to look for work.

Treasury 10-year note yields rose to the highest since November as a report showed U.S. employers cut the least jobs in eight months during May, bolstering expectations that the worst of the recession may be over.

ECB Slashes Euro Zone growth Forecast

The bank's new staff forecasts predicted the euro zone economy would now shrink by up to 5.1 percent this year and signaled it would also struggle to grow in 2010 -- forecasting a change in GDP of between -1 percent and +0.4 percent.Inflation would not return to positive territory until the end of this year and was "firmly anchored," ECB President Jean-Claude Trichet said, detailing unchanged forecasts for price growth next year of between 0.6 and 1.4 percent

more at : http://www.cnbc.com/id/31100752

News Today - June 04

* The jobless rate climbed to 9.2 percent in the 16 Eurozone nations of the EU, the highest rate in a decade. In the U.S. unemployment has hit a 25-year high of 8.9 percent and Hong Kong unemployment hit a three-year high of 5.3 percent in April.

* Federal Reserve Chairman Ben Bernanke sounded a cautiously upbeat note on the US economy on Wednesday but warned that corralling government debt was vital to ensuring the nation's long-term health. In testimony to Congress, Bernanke sounded more confident that the U.S. recession would end this year than he had just one month ago, and he said the risk of a dangerous downward spiral in prices had receded.

* Silver tops gold and platinum to become the fastest-rising precious metal. Analysts say it may keep outperforming.

* Berkshire Hathaway Chairman Warren Buffett said Saturday that he sees some signs of stabilization in housing markets."In the last few months you've seen a real pickup in activity although at much lower prices," Buffett said, citing data from Berkshire's real estate brokerage business, which is one of the largest in the U.S.

News Today - 03 June

* U.S. analysts say Treasury chief did a good job in handling Chinese leaders during his Beijing trip, despite tensions simmering below the surface.

* Toyota said on Tuesday that the US automotive market appeared to be recovering even as it posted a 38 per cent drop in May US sales

* Bank of America Corp, JPMorgan Chase & Co and several other banks said they have raised more than $19 billion as lenders scramble to repay TARP funds

* Bankrupt General Motors says it has reached a tentative deal to sell Hummer, its military-styled vehicle line, to a machinery maker based in western China.

Eurozone Jobless Rate Climbs to 9.2%

The seasonally adjusted unemployment rate for the 16 nations in the euro area rose to 9.2 percent in April, the highest rate since September 1999, from 8.9 percent in March, according to the Eurostat agency. During the same month a year earlier, the rate was 7.3 percent.

For all 27 members of the E.U., the unemployment rate was 8.6 percent in April, up from 8.4 percent in March and 6.8 percent in April 2008.

Although there has been some evidence in recent weeks that the economic decline that intensified in Europe in the second half of last year is beginning to ease, economists note that the labor market lags behind many economic indicators and that unemployment commonly rises after a downturn.Source : http://www.nytimes.com/2009/06/03/business/global/03euro.html?ref=business

BRIC Nations Consider Alternative Currency to Dollar

"I do not exclude that the Russian president's idea about the creation of a supranational currency and the rouble as a (world) reserve currency will be discussed," Medvedev's spokeswoman, Natalya Timakova, told reporters.

When asked if the summit would include a discussion of ways to reduce dependence on the dollar, she said: "If one of the (BRIC) participants raises this question then I do not exclude it" (a discussion).

Russia has proposed the creation of a new world reserve currency that would be issued by international financial institutions to reduce reliance on the U.S. dollar.

The leaders of Brazil, Russia, India and China, known by the BRIC acronym, are due to meet in the Russian city of Yekaterinburg on June 16 for the first summit since the international downturn struck their economies, which had driven global growth.

Source : http://www.cnbc.com/id/31061545News Today - June 02

* J.P. Morgan and AmEx announced unexpected plans to sell stock after the government said large banks must first prove they can raise money from private investors before exiting TARP.

* Chrysler could exit bankruptcy reorganization as soon as Monday. A judge approved the sale of most of Chrysler's assets to alliance partner Fiat.

* US Treasury Secretary Timothy Geithner said Chinese officials are confident in the U.S. economy and the Obama administration’s actions to fight the recession and restore financial stability.

* Air France plane with 228 people on board was presumed to have crashed into the Atlantic Ocean on Monday after hitting heavy turbulence on a flight from Rio de Janeiro to Paris.

Coppock Indicator gives a buy signal for DOW

what is the Cappock Indicator ?

The Coppock Indicator is quite an unusual component of technical analysis in that it based upon a psychological "period of mourning" to identify buy signals after a time of bearish activity. The indicator was created by Edwin Coppock and was first published in Barron's Magazine in 1962.

The Cappock Indicator is regarded to be one of the most accurate indicators in predict market bottoms and signals for Long term Investments. But it also has had some major missteps. The Coppock Guide gave a buy signal in December 2001, for example, nearly a year prior to the final low of the 2000-2002 bear market. And the indicator appears to have also flashed two premature buy signals during 1931, at levels well above the market's mid-1932 low. Lets see how accurate it works this time.

Inputs From :

Mark Hulbert, MarketWatch

http://www.marketwatch.com/story/coppock-guide-finally-issues-a-buy-signal

http://www.trading-talk.co.uk/technicals/technical-analysis---coppock-indicator.html

Previously

Dow Theory Tells you to sell,It turned out to be right

http://marketpulz.blogspot.com/2009/02/dow-theory-tells-you-to-sell.html

Biggest US Bankruptcies

1. Lehman Brothers - investment banking (2008)

2. Washington Mutual - savings and loan holding (2008)

3.WorldCom - telecom (2002)

4. General Motors - auto (2009)

5. Enron- energy (2001)

6. Conseco - insurance and finance (2002)

7.Chrysler - auto (2009)

8.Thornburg Mortgage Inc - residential mortgage lender (2009)

9. Pacific Gas and Electric Company - electricity and natural gas (2001)

10.Texaco - petroleum major (1987)

GM Files Bankruptcy

GM reported $82.29 billion in assets and $172.81 billion in debt. The U.S. government will bankroll the transformation of the 100-year-old automaker, a victim of tumbling sales and higher gas prices. The U.S. plans to convert much of its $50 billion of loans to a 60 percent stake in the new entity, administration officials said. Today’s filing coincides with a deadline for GM to convince a government auto task force that it could reorganize out of court through debt and cost cutting.

The future of thousands of car industry jobs in Europe remain uncertain as General Motors files for bankruptcy after reaching a deal to sell off its European operations, including German automaker Opel.

Source : http://www.bloomberg.com/apps/news?pid=20601087&refer=top_news&sid=aZ94r84yT8Ds

http://edition.cnn.com/2009/BUSINESS/06/01/gm.europe/index.html

Investors sceptical on stock market rebound

The majority of the world’s leading investors do not believe the recent strong performance of stocks and other risky assets is sustainable, according to a report released on Monday.

The FTSE All World equities index has surged more than 60 per cent since hitting a low for the year in March.

But Barclays Capital has revealed that just 17.5 per cent of the 605 investors interviewed for its quarterly FX investor sentiment survey – including central banks, asset managers, hedge funds and international corporate customers – think risky assets have further to rise.his is one aspect of a generally gloomy outlook for the global economy, which undermines optimism that “green shoots” of recovery are starting to emerge.

Just 4.5 per cent of respondents believe the trajectory of the global economy over the next year will be “V-shaped” – indicating weakness followed by a sharp recovery.

The majority, 69 per cent, believe the path of the global economy will be either “U-shaped” or “W-shaped”, meaning that growth will remain weak for some time before a gradual recovery begins, or that a recovery will prove temporary and renewed weakness will set in.

By Peter Garnham in London

http://www.ft.com/cms/s/0/52c9f2a8-4e1a-11de-a0a1-00144feabdc0.html

News Today - June 01

* US Treasury Secretary Tim Geithner is set to meet with several high-ranking members of the Chinese leadership this week, marking the Obama administration's first major overture to the powerhouse nation.

* Chinese manufacturing expanded for a third month in May, indicating the economic recovery remains intact and helping to erase concerns the world's third-largest economy was beginning to lose momentum.

* Heavy job losses battered American families again in May, economists say, erasing almost all the employment gains over the past decade.

* India Inc feels the economy has started recuperating and can move to a higher growth trajectory in the next few months, as per a survey by industry body FICCI. Half of the companies that took part in the survey posted better growth in the fourth quarter of 2008-09 compared with the previous two quarters.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e0c5c570-2007-4381-b789-c2fe2f67f2f6)